Are you thinking about purchasing a home? Knowing and improving your credit score should be on your list of things to do before you start looking for a home. No matter what lender you finance with, one of the first things they will do is pull your credit report and break down every loan, credit card, late payment etc. to establish your worthiness of getting a loan. To qualify for a mortgage, your credit score is actually the second factor taken into consideration for your pre-approval (first is your income). With this level of importance it is well worth your time to prepare beforehand and make sure all of your accounts are in good standing. Here is a list of 5 ways to improve your credit score based on scenarios I have experienced with borrowers in the past.

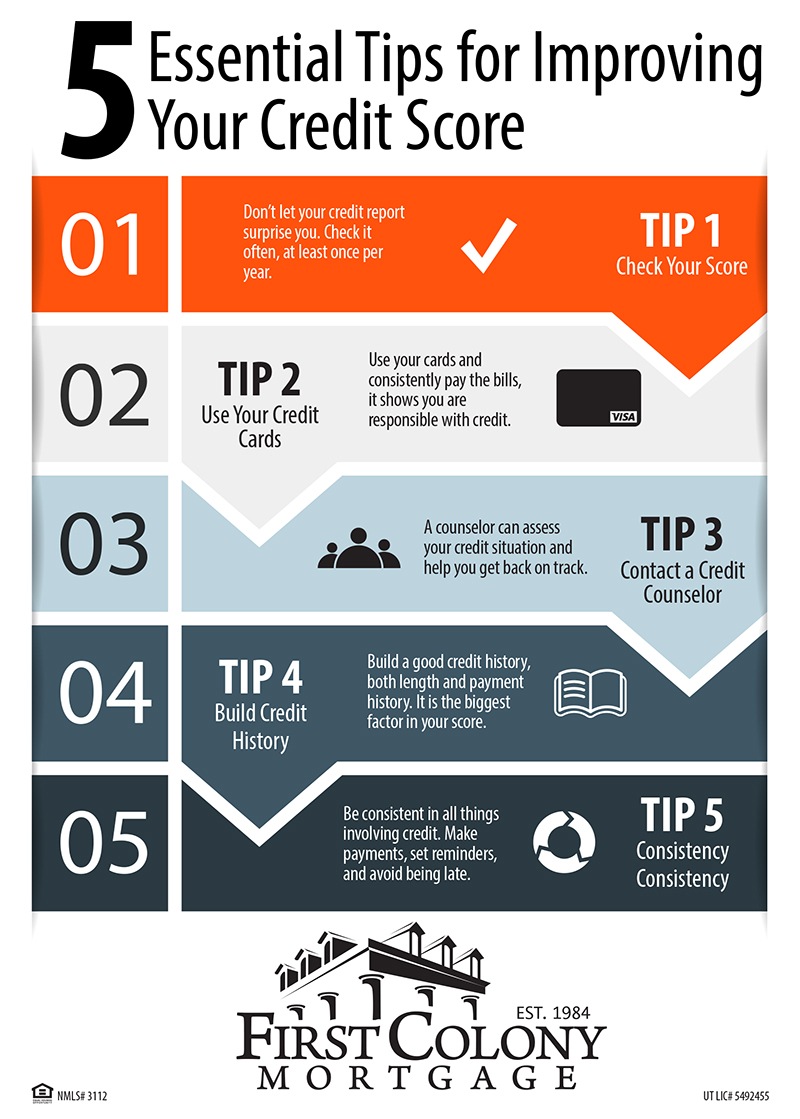

1. Check Your Score – Don’t Let it Surprise You

Knowing what needs to be fixed is half of the battle. There are many occasions where borrowers will come in and we will look over their credit report and they’ll say, “What is that doing there? I don’t have that anymore.” or something similar. Each year you are given a free credit report (which can be obtained here) without the pull affecting your score. There are many companies out there saying they can give you a free credit report but it’s important to get your information from a reliable source. Keep in mind that the credit report that you pull as a consumer is going to be different than what the car salesman or mortgage lender pulls.

2. Use Your Credit Cards – Seriously

This doesn’t mean that you should go out and open a bunch of new credit cards and max them out, that is far from the truth. A good rule of thumb is to pay down your current credit card balances to have more available credit. Keeping your card balances low or even maintaining a zero balance is a good thing. The more credit available you have on your card looks good on your report, so having $5000 available credit looks much better than $1000. A key to think about is consistently using those cards. A history of credit card use with a good routine of paying your credit card bills shows the reporting agencies you’re responsible and it’s reflected in your score. A big mistake people commonly make is paying off their credit cards and getting rid of them completely. This adversely affects your credit score because you’ve lost that history of good credit and consistently paying your debts.

3. Contact a Credit Counselor They Don’t Bite

Contacting a Credit Counselor will not decrease your credit score. They will look over your situation and see what can be done to help you make your payments. If you are having trouble making payments on time a bit advice would be to call the creditor and ask what options are available to adjust your repayment plan. This is a much better course than not making payments at all and defaulting on the loan. You would be surprised how much banks and other lenders will be willing to work with you if you ask.

4. Credit History is Your Friend – Including Old Debts

One of the biggest factors of your credit score is your history. That can be anything from current credit cards to a car or house you paid off already. It may surprise you but your payment history determines 35% of your score and the length of your credit history is another 15%. After paying off a large debt many people think they need to get it off their record to improve their score, not true. Trying to get rid of old debt that you have paid off is “like making straight A’s in high school and trying to expunge the record 20 years later,” says John Ulzheimer, president of consumer education for SmartCredit.com. “You never want that stuff to come off your history.” Your credit history can help you, particularly if you have had a stellar track record of making payments.

5. Consistency, Consistency, Consistency

I cannot stress this enough. Being on time and consistent with your bill payments is the best remedy to improving anyone’s credit score. One tip is to set up payment reminders on your phone, iPad, laptop, or anywhere that you will see on a daily basis. This will prevent the annoying 30 days late dings to your credit score.

There is not an easy ‘fix’ to your credit score unless of course something was misreported. It takes time and patience to rebuild your credit after a financial mishap. It’s true that unexpected financial emergencies happen but the best advice in regards to helping your credit score is to maintain a good payment history (as best you can), to keep long term lines of credit open, and to monitor your score on a yearly basis.

Travis Van Noy

Loan Originator NMLS #1065251

130 W. Center St., Ste. 201, Orem, UT 84057

Office: 801.437.4577 Fax: 801.437.4575 Cell: 775.772.7858

email: [email protected]

Thank you to Travis Van Noy of First Colony Mortgage for providing this post!

Nice blog! The information given in this article will surely be of use to me. Thanks!

Great post! I will follow these tips and improve my financial creditability within a year.

Comments are closed.